Types of Home Mortgages

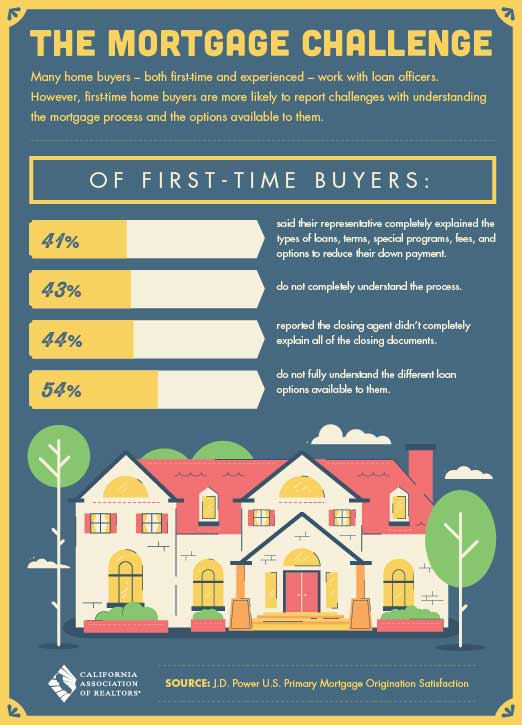

I recently saw the following infographic from California Association of Realtors “One Cool Thing.”

The last statistic struck me: over half of first time buyers did not understand their loan options. Of course, while the best advice I can give is to talk to a qualified mortgage professional, I decided to do some digging and find some helpful resources on the matter. Below you will find two articles I found characterizing and summarizing the common types of home mortgages.

Common Types of Home Mortgages

From USA.gov

Fixed rate and adjustable rate mortgages are the two main types of mortgages, but there is a wide variety of other mortgage products available. Below are pros and cons of just a few of the mortgage products you may want to consider.

| Type of Mortgage | Pros | Cons |

| Fixed-rate mortgage | No surprises. The interest rate stays the same over the entire term, usually 15, 20 or 30 years. | If interest rates fall, you could be stuck paying a higher rate. |

| Adjustable-rate (ARM) or variable-rate mortgage | Usually offers a lower initial rate of interest than fixed-rate loans. | After an initial period, rates fluctuate over the life of the loan. When interest rates rise, generally so do your loan payments. |

| FHA (Federal Housing Administration) loan | Allows buyers who may not qualify for a home loan to obtain one. Low down payment. | The size of your loan may be limited. |

| VA loan | Guaranteed loans for eligible veterans, active duty personnel and surviving spouses. Offers competitive rates, low or no down payments. | The size of your loan may be limited. |

| Balloon mortgage | Usually a fixed rate loan with relatively low payments for a fixed period. | After an initial period, the entire balance of the loan is due immediately. This type of loan may be risky for some borrowers. |

| Interest-only | Borrower pays only the interest on the loan, in monthly payments, for a fixed term. | After an initial period, the balance of the loan is due. This could mean much higher payments, paying a lump sum or refinancing. |

| Reverse mortgage | Allows seniors to convert equity in their homes to cash; you don’t have to pay back the loan and interest as long as you live in the house. | Subject to aggressive lending practices and false advertising promises, particularly by lenders that prey on seniors. Check to make sure the loan is Federally insured. |

More on Fixed Rate Mortgages

From: HomeLoanLearningCenter.com

The 30-year fixed-rate mortgage

Not long ago, there was only one kind of mortgage: 30-year fixed rate (the borrower has 30 years to pay back the mortgage at a fixed interest rate and the payments are the same over the life of the loan). It is still the most common home loan.

Borrowers choose fixed-rate loans because the mortgage payments are steady and predictable, allowing for easier household budgeting and planning. The payments are the same over the life of the mortgage, regardless of interest rate changes. Initially, both the rate and mortgage payment are higher than those of an adjustable-rate mortgage, but the payment is lower than that of a 15-year fixed-rate mortgage (see below). People who choose a fixed-rate mortgage usually are planning to keep their home and mortgage for several years.

The 15-year fixed-rate mortgage

This type of mortgage enables you to own your home in half the usual time, meaning you could possibly own it before your children start college or you reach retirement. Because the loan is shorter, you pay substantially less in the total interest over the life of the loan, often less than half the total interest of a 30-year fixed-rate loan. However, because the term is shorter, the monthly payments are higher than those of a 30-year mortgage. For people who can afford the higher monthly payments, this is an excellent choice, with lower total costs and a shorter term. Qualification for this type of loan may be more difficult because the income requirement may be higher.

Additional Resources:

- How to Figure Interest on Mortgage Loans

- Prepaying Mortgage to save on interest

- 15 vs. 30 Year Mortgages

- 3 Ways to Pay Your Mortgage Faster

Ready to make your own move? Contact me to find out:

Want to be emailed any time a property comes to the market?